In today’s competitive business landscape, understanding and optimizing customer acquisition cost (CAC) is crucial for growth and profitability.

A clear grasp of CAC allows businesses to make informed decisions about marketing investments, sales strategies, and customer retention.

In this article, we’ll explore the concept of CAC, the factors that affect it, and practical steps you can use to improve this critical business metric.

Let’s get right into it!

Understanding customer acquisition cost

Customer acquisition cost (CAC) is the total cost associated with acquiring a new customer, which includes both marketing and sales expenses.

Understanding CAC is essential for businesses, as it helps them track their sales and marketing efficiency to determine if their efforts are yielding a good return on investment. A CAC that is lower than the customer lifetime value indicates a successful company, as it means that the business is spending less to acquire customers than the revenue they’ll generate.

CAC has increased by approximately 60% between 2014 and 2019, which demonstrates the growing importance of optimizing marketing and sales strategies to minimize customer acquisition costs.

How to calculate customer acquisition cost

To calculate CAC, businesses can use the following formula:

CAC = (Total Marketing Spend + Sales Expenses) / Number of New Customers Acquired

First, determine the time period for which you want to calculate the cost. This could be a month, a quarter, or a year.

Next, add together all the marketing and sales expenses incurred during that period. To accurately assess the overall financial impact of acquiring new customers, businesses can benefit from utilizing an employee cost calculator.

This invaluable tool helps organizations calculate the true cost of their employees, factoring in not only their salaries but also additional expenses such as benefits, training, taxes, and overhead costs.

Moreover, it enables businesses to quickly create pay stubs, streamlining the payroll process and ensuring accurate compensation.

Once you have the total marketing and sales expenses, divide this figure by the number of new customers gained during the same time period.

This calculation allows companies to evaluate their marketing and sales expenses and determine if they’re spending too much or too little on acquiring new customers.

By monitoring CAC, businesses can identify areas for improvement and make strategic decisions to increase the average customer lifespan and drive profitability.

Factors that affect customer acquisition cost

Several factors can impact CAC, such as:

- the type of business,

- the market in which it operates, and

- the strategy it employs to acquire customers.

Launching a new business, entering a new market, or executing a new strategy may result in an increase in CAC. However, by closely monitoring metrics and making adjustments as necessary, businesses can optimize their CAC over time.

It’s essential for businesses to understand the factors affecting their CAC and take proactive measures to optimize it.

This can be achieved through continuous monitoring and analysis of sales and marketing efforts, as well as benchmarking against industry standards to identify areas for improvement and set realistic goals.

5 tips for reducing and improving customer acquisition cost

To reduce and improve CAC, businesses can implement a variety of strategies and best practices.

1. Leverage customer feedback

Leveraging customer feedback can help to pinpoint areas of the customer experience that need improvement, which can help lower your CAC.

By asking for feedback from visitors who don’t convert, you’ll gain important insights into what’s working and what’s not, so you can make the necessary changes.

By applying their suggestions, you’ll be able to optimize your landing pages for maximum engagement, conversion, and revenue growth!

You can get started with one of our Exit Feedback Survey templates:

Recommended reading: How to Get Customer Feedback (15 Tried-and-Tested Methods)

2. Analyze customers

Examine customer demographics, purchasing behaviors, and website analytics to find areas you could improve the user experience.

Making changes based on these findings can help improve the CAC:LTV ratio by increasing customer retention and loyalty.

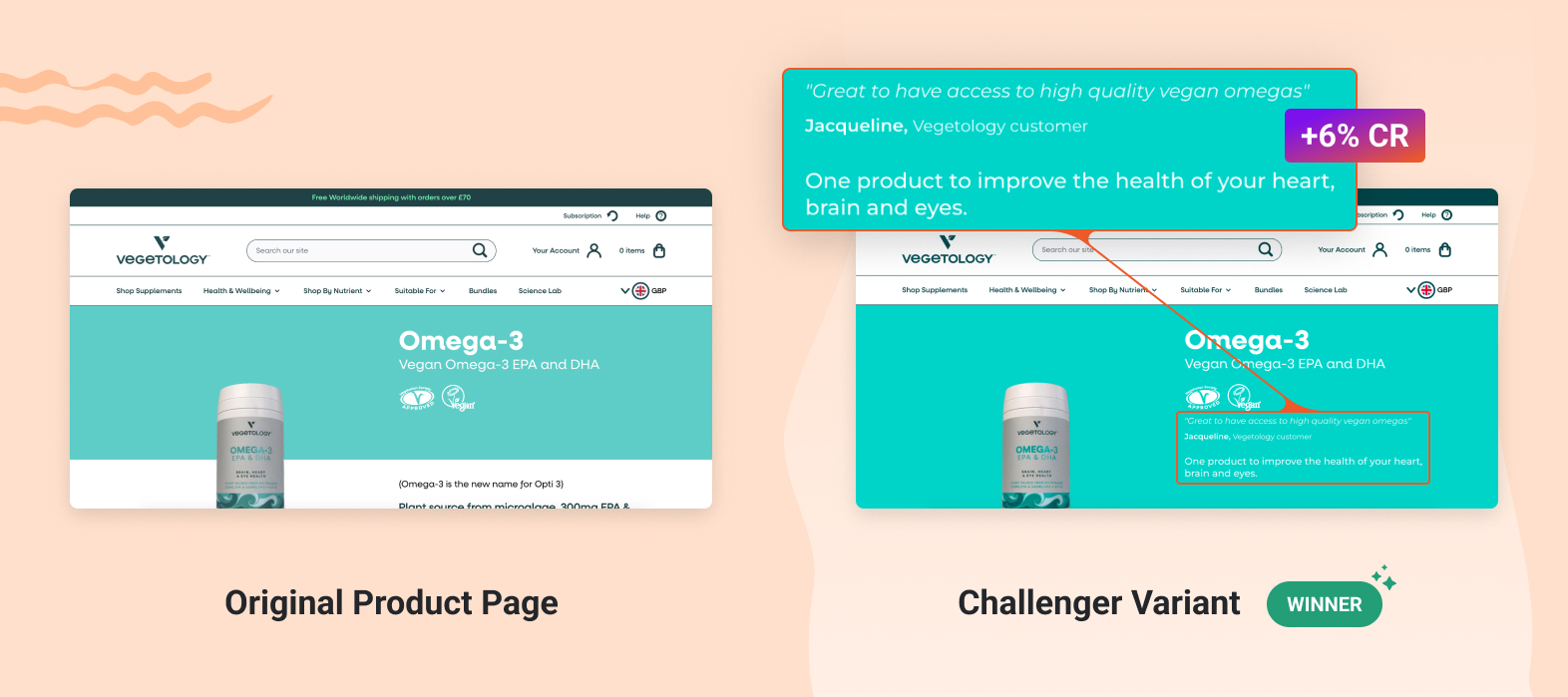

3. Display social proof

Displaying testimonials from customers who love your product is a great way to eliminate common customer concerns and increase conversion rates.

Vegetology tried this strategy and added a testimonial at the top of their product pages. This led to a 6% increase in the conversion rate.

4. Use exit-intent popups

Exit-intent popups are crucial for preventing customers from leaving a page or abandoning their shopping carts and ensuring that they complete their purchase, reducing CAC.

With a special discount, you can entice those hesitant shoppers to complete their purchase and become customers.

Check out these Cart Abandonment Stopper templates:

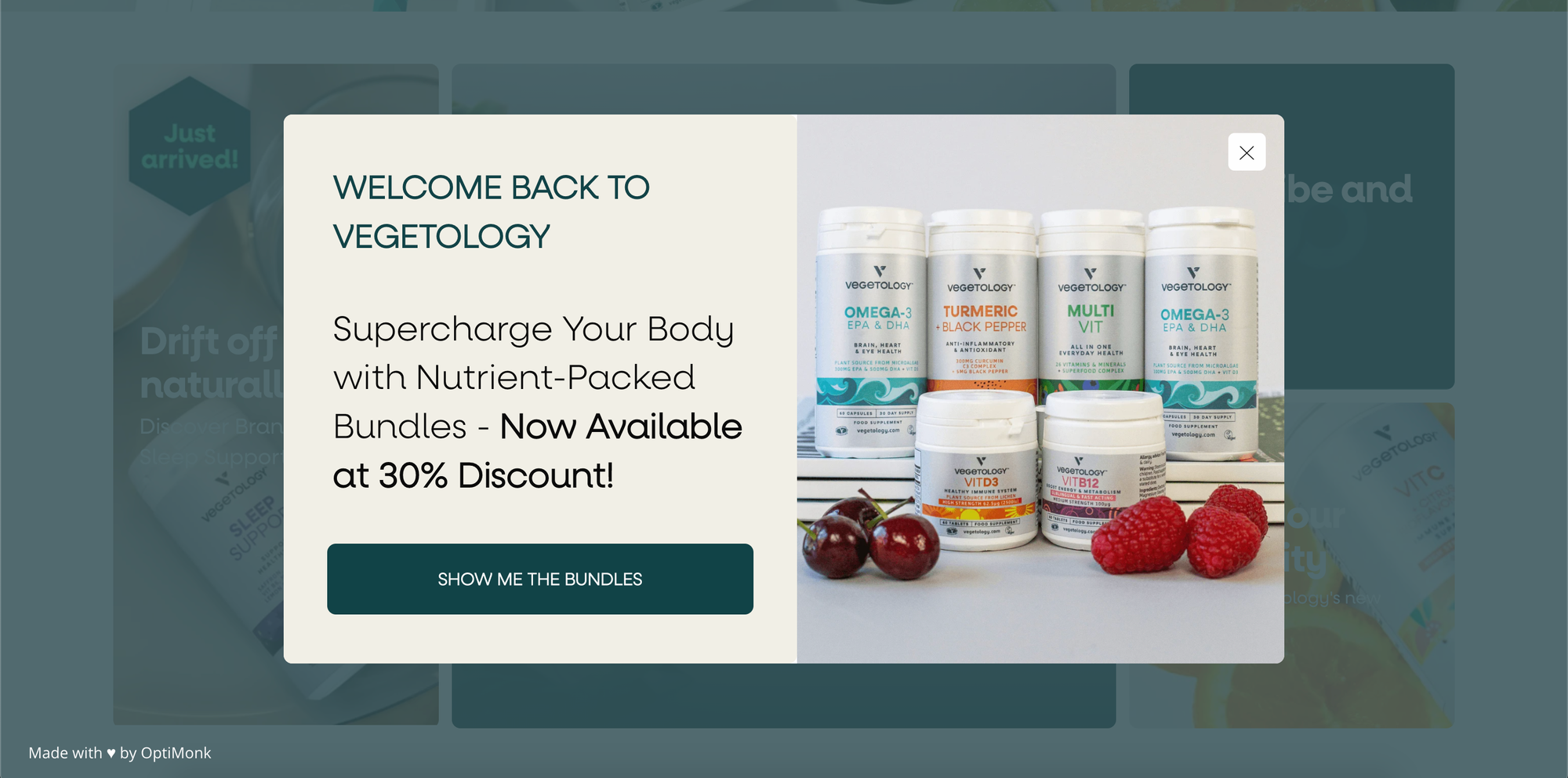

5. Improve the purchase frequency

With a simple welcome back popup that promotes a special offer for returning customers, you can encourage them to keep coming back and boost your sales like never before.

Check out how Vegetology used this strategy and achieved a 14.59% click-through rate.

By implementing these tips, you can optimize your CAC and drive long-term profitability.

Utilizing technology to optimize CAC

Incorporating technology can play a significant role in optimizing CAC and enhancing customer interactions.

Chatbots, marketing automation, Google Analytics, and A/B testing are some of the technologies that can be employed to reduce CAC and improve the customer experience.

A CRM is a customer relationship management software that helps you develop better customer relationships, address their needs, and decrease CAC.

Incorporating chatbots and marketing automation can augment your team’s workflow and optimize your company’s overall productivity, while analyzing existing data helps identify which marketing investments offer the highest return on investment.

FAQ

What is customer acquisition with example?

Customer acquisition is the process of convincing potential customers to buy your product or service. For example, this could be through targeted email campaigns, online advertising, offering special discounts, or utilizing an effective referral program.

Customer acquisition allows businesses to grow their customer base and increase sales revenue.

What is customer acquisition cost with example?

Customer acquisition cost (CAC) is a measure of how much it costs a business to acquire a new customer. For instance, if a company spends $15,000 on marketing and sales initiatives in one month and earns 150 customers from those efforts, its CAC would be calculated as $100.

How do I calculate customer acquisition cost?

Calculating customer acquisition cost (CAC) is straightforward. It involves dividing the total costs associated with acquiring new customers by the total number of new customers acquired within a given time period.

This calculation can help you understand how much it costs to acquire a new customer, and it can be used to inform decisions about marketing and sales strategies.

What is CAC vs CPA?

CAC and CPA are important metrics to measure the success of customer acquisition campaigns. CAC measures the cost of acquiring a customer, while CPA measures the cost of acquiring a lead.

They’re both useful for evaluating the efficacy of marketing strategies and investments in customer acquisition efforts.

What is customer lifetime value and how is it related to CAC

Customer lifetime value is the revenue obtained from a customer over the length of the relationship. Assessing customer lifetime value is vital for evaluating the effectiveness of a business’s CAC investments, as it helps determine if investing in marketing is advantageous.

Wrapping up

Understanding and optimizing customer acquisition costs is a key factor for business success and growth. CAC helps businesses make informed decisions about their marketing investments and sales strategies. By comparing CAC to customer lifetime value, businesses can evaluate the profitability of their organization and identify areas for improvement.

Implementing tips for reducing and improving CAC, such as aligning strategies with customer preferences, leveraging customer feedback, and enhancing conversion rates, can drive long-term profitability. Utilizing technology, including chatbots, marketing automation, and Google Analytics, can further optimize CAC and improve the overall customer experience.

By applying the concepts and strategies in this article, you can optimize your customer acquisition cost, drive growth, and achieve long-term success in today’s competitive market landscape.